do u pay taxes when u sell a car

In the US it depends. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and Customs rules mean that you dont pay Capital Gains Tax.

Once the buyer has the vehicle registered under his name he must pay to sell Texas.

. So if your used vehicle costs 20000 and you live in a state that charges a 6 sales tax the sales tax will raise your cars purchase price to 21200 excluding any additional taxes or fees you. Like New Wrecked or Not Running. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and Customs rules mean that you dont pay Capital Gains Tax.

So youll owe no tax. For example if you purchase a car for 10000 spend 2000 improving it and then sell it for 11000 it is considered a capital loss and you dont need to pay any tax. How much tax do you pay when you sell a car.

That tax rate is 725 plus local tax. You do not need to pay sales tax when you are selling the vehicle. We Can Get A Buyer To You Fast.

Unless its part of negotiations the buyer will be required to pay all applicable fees and taxes to local authorities. 22000 111. Basically the Internal Revenue Service IRS views all personal vehicles as capital assets.

In California you do not have to pay any taxes on car that has been sold however upon purchase of a different car you will pay taxes on that. Traditionally the buyer of a car is the one concerned about paying taxes. But if that car sells for 15000 you will have made 3000 profit and will need to pay tax on that 3000.

Check your Department of motor vehicles for other states. You dont have to pay taxes if you are selling your car for cash because you already own the car and have paid the taxes for it. For vehicles less than 44999 the rate is 3 per 100 or part thereof and over 45000 it jumps to 5 per 100 or part thereof.

Most car sales involve a vehicle that you bought new and are selling used and in this case you will typically not generate income that needs to be taxed. If you sell it for less than the. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625.

Sample Pty Ltd sells computers and is registered for GST. Thankfully the solution to this dilemma is pretty simple. Author has 11K answers and 17M answer views Updated 1 y Related.

Harley Michael Best to stay silent if you dont know the correct answer. In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. The company sells a second-hand motor vehicle with a market value of 22000 to one of the directors for 2200.

AUTOBUY has been offering cash for cars for over 20 years now and they have a fast and efficient method of purchasing cars. We Will Buy Your Car Truck SUV Today. Even though the director only paid 2200 GST must be calculated as though the director paid 22000.

Although a car is considered a capital asset when you originally purchase it both state and federal governments consider selling your car for more than you invested as a profit. The short answer is maybe There are some circumstances where you must pay taxes on a car sale. If I sell my car do I pay taxes.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Some owners will apply for a refund of any remaining Vehicle Excise Duty car tax on the vehicle though this is usually factored into the deal as part of the value of the car. Tax is also.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Instead the buyer is responsible for paying any sale taxes. New South Wales Across the border from the ACT stamp duty is based on the higher of either the price paid for the vehicle or its market value.

The buyer will have to pay the sales tax when they get the car registered under their name. Answer 1 of 6. Reporting the Sale for Tax Purposes.

However you do not pay that tax to the car dealer or individual selling the car. However unless youve got an old Mustang or other classic car its unlikely that your cars value went up. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes.

GST payable by Sample Pty Ltd. When you sell your car for cash you can spend the cash on anyway you like. If you sold the car for more than the total cost calculated in steps 1-3 then youll owe tax on that amount.

You dont have to pay any taxes when you sell a private car. When you sell your car only the portion of the selling price that exceeds the adjusted basis of the car is taxable gain. Youll report it on Schedule D of Form 1040 on your tax return.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Do I Pay Taxes When Selling My Car. Be sure youre getting a fair price when you go to sell your junk car.

Do u pay taxes when u sell a car Tuesday May 10 2022 Edit. For example if your car has an adjusted basis of 5000 and you sell the car for 6000 you have a gain of 1000.

How Used Cars And Sales Taxes Are Building The Digital Future Used Cars Banking App Digital

Cash For Junk Cars Same Day Pick Up No Title Sell Your Car And Get Cash Instantly Car Loan Calculator Cash Personal Finance Blogs

Selling A Used Car Is Easy When You Know These Tips Sellmycar Ae Want To Sell Your Car We Buy Any Car Things To Sell Car Sell Car

5 Helpful Tips To Correctly File Your Tax Return Used Cars Car Buying Tips Car Buyer

Red Door Realty Selling House Tax Deductions Selling Your House

Smiley Says Come On By Family Auto Of Anderson We Ll File Your Taxes So You Can Drive It Home Car Dealer Used Cars Used Cars And Trucks

Car Bill Of Sale Printable Bill Of Sale Template Bill Of Sale Car Bill Template

How To Sell A Car With A Lien Credit Karma

Canadian Fine Motors In 2021 Used Cars Cars For Sale Car Dealer

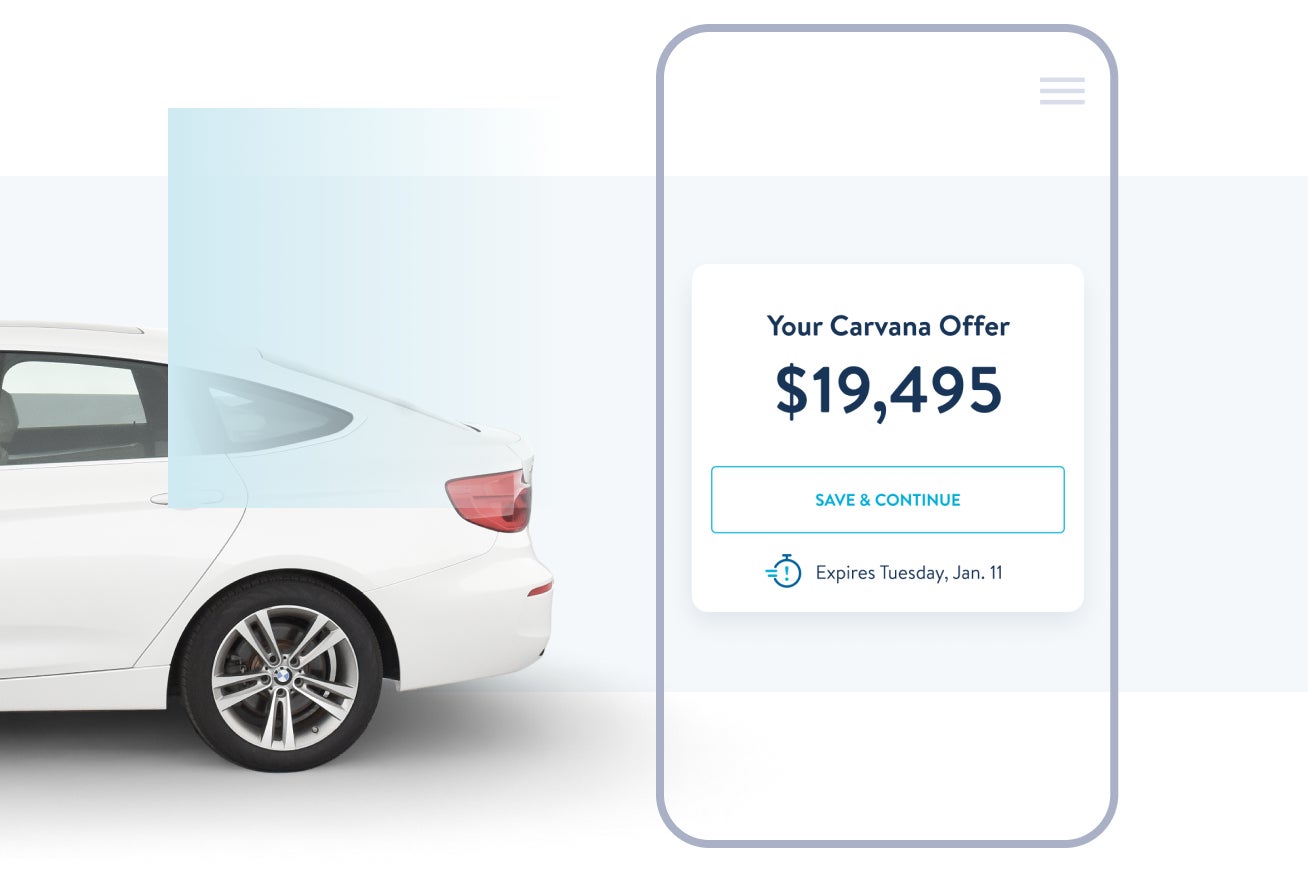

Selling Or Trading In Your Car To Carvana How It Works Carvana

Cars For Sale In Greer Sc Cheap Used Cars For Sale Happy Auto Cars For Sale Cheap Used Cars Used Cars

Why Should One Have To Pay Taxes On Used Car Driving Instructor Sell Car Wedding Photo Booth Props

What S The Car Sales Tax In Each State Find The Best Car Price

Didyouknow You Can Sell Us Your Car With Rcu Auto Services Selling Your Car Is Easy Fair And Fast With No Strings Attached Auto Service Car Autotrader

Car Dealers Melbourne Autoline Car Sales Cars For Sale Car Dealer Best Car Deals

Free Motor Vehicle Dmv Bill Of Sale Form Pdf Word

Contract For Selling A Car New How To Write A Contract For Selling A Car Hashtag Bg Cars For Sale Sell Car Contract Template